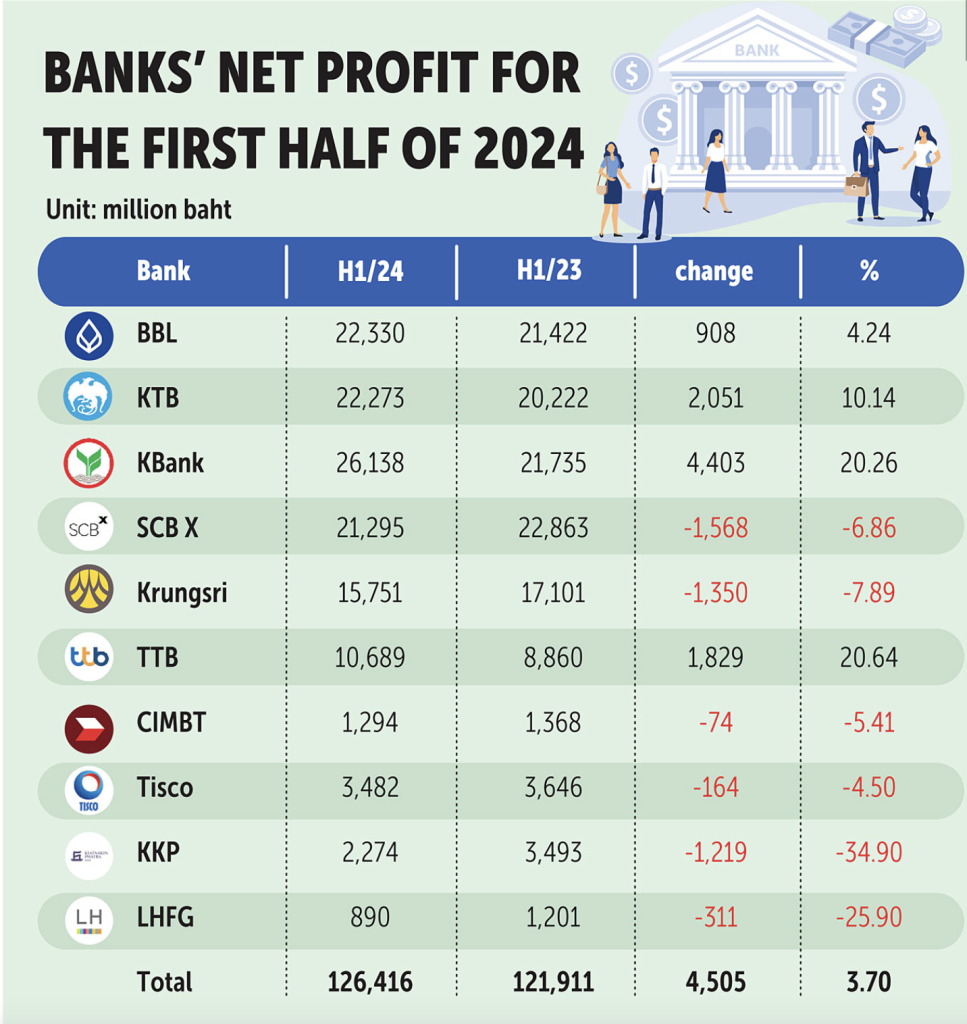

The combined net profit of 10 SET-listed banks reached 126.4 billion baht in the first half of 2024, reflecting a 3.7% year-on-year increase. This growth was predominantly led by larger banks, while smaller banks faced a downturn in profits. Out of the 10 financial institutions, four showed improved net profits in the first half of 2024 compared to the same period last year.

TMBThanachart Bank (ttb) emerged as the top performer with a growth rate of 20.6%, achieving a net profit of 10.6 billion baht in the first half, up from 8.86 billion baht in the corresponding period last year.

In a statement to the Stock Exchange of Thailand, ttb reaffirmed its commitment to a prudent business strategy focused on selective loan growth and liquidity recycling to ensure risk-adjusted returns and maintain financial stability in the face of economic challenges.

Emphasizing cost management as a key improvement factor, ttb underscored the importance of strategic financial planning.

Conversely, Kiatnakin Phatra (KKP) reported the lowest industry result, with a net profit of 2.27 billion baht in the first half, marking a 34.9% decrease from 3.49 billion baht in the same period in 2023. This decline was attributed to reduced net interest income due to slower loan growth.

KKP’s auto hire-purchase loan portfolio was notably affected by a 23.8% year-on-year drop in the auto industry during the first five months of 2024.

With commercial and passenger car sales declining by 27.1% and 17.9% year-on-year, respectively, during the period, challenging economic conditions, higher interest rates, and increased household debt rates were identified as contributing factors.

Siam Commercial Bank (SCB), led by chief executive Kris Chantanotoke, emphasized the bank’s cautious approach aligning with the economic landscape and addressing higher credit risks in specific customer segments.

Anticipating forthcoming economic difficulties in the second half of the year, SCB emphasized the importance of robust risk management and adherence to best practices.

Despite concerns about asset quality deterioration in vulnerable customer segments, SCB is committed to effective management of non-performing loans (NPLs) throughout the year, supported by a selective loan growth strategy to preserve asset quality.

While major local banks targeted a 2024 loan growth in the 3-5% range on average, the country’s domestic systemically important banks (D-SIBs) experienced a loan contraction in the first six months of 2024.

The D-SIBs, comprising Bangkok Bank, Krungthai Bank, Kasikornbank, SCB, Bank of Ayudhya, and ttb, collectively recorded a total outstanding loan volume of 13.4 trillion baht as of June, a slight decrease of 0.11% from 13.5 trillion baht as of December 2023.

Bangkok Bank (BBL), the largest bank in the country by total assets, achieved the highest loan growth among the D-SIBs at 1.8%, contrasting with the marginal or flat contractions seen among its peers.