Cracks and damage observed in numerous high-rise condominiums in Bangkok following Friday’s earthquake have shaken consumer confidence. As a result, the second quarter of this year is expected to be the weakest for condo sales and transfers in the past 15 years.

Credit: Bangkok Post

Phattarachai Taweewong, the research and communications director at property consultancy Colliers Thailand, indicated that both foot traffic from potential buyers and new condo sales in Greater Bangkok, especially for high-rise units, are anticipated to decline sharply in the second quarter.

“The earthquake has greatly diminished the confidence of condo buyers, and recovery will require at least three months,” he noted. “Those who bought units previously and are set for transfer might postpone their moves to evaluate the situation and ensure the safety of high-rise buildings.”

According to the Thai Condominium Association, new condo sales in the third quarter of 2024 reached their lowest point in 14 years, reminiscent of 2010’s second quarter, totaling 19 billion baht.

The second quarter of 2025 is expected to see even lower new sales due to waning consumer confidence in condo investments.

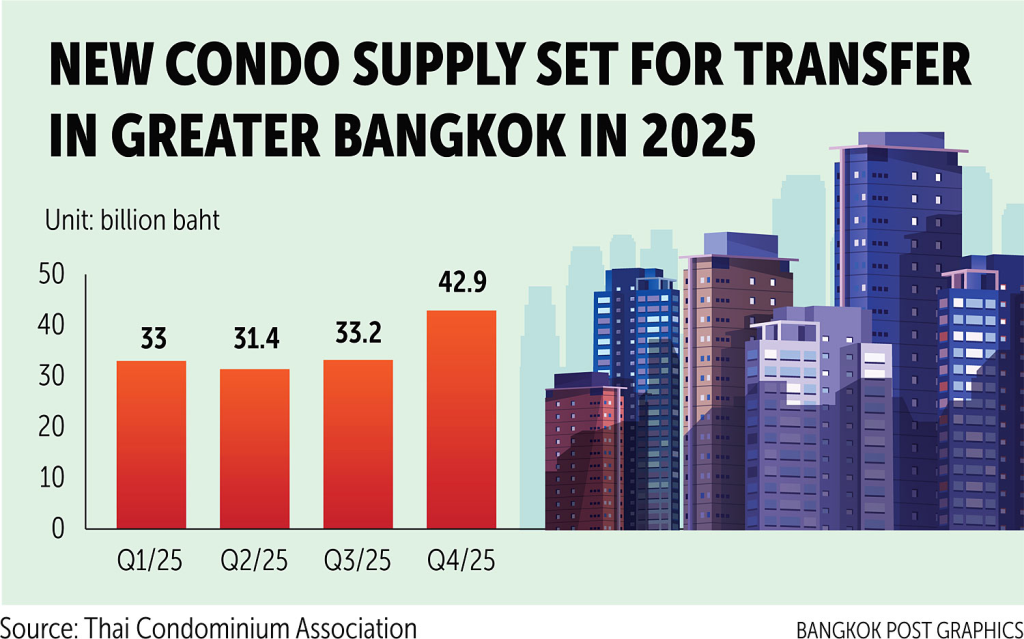

At the same time, new condo supply in Greater Bangkok slated for transfer in the second quarter of 2025 is projected to reach 31.4 billion baht, following 33 billion baht in the first quarter. In contrast, the highest figure was recorded in the fourth quarter of 2024, at 85.9 billion baht, culminating in a total of 178.4 billion baht for the year. These figures included both the sales backlog set for transfer and unsold inventory.

This unsold inventory will add to the already existing supply, which amounted to 458.4 billion baht, according to Mr. Phattarachai.

Following the earthquake on March 28, there is an anticipated increase in demand for low-rise homes, which are viewed as less susceptible to seismic activity. This shift mirrors the trend observed in 2011 when heavy flooding prompted buyers to favor condos over low-rise houses.

Surachet Kongcheep, head of research and consultancy at Cushman & Wakefield Thailand, predicted that sales and transfers of low-rise homes will either remain stable or increase, unlike condos.

“New condo sales are certain to decline, and developers are unlikely to hasten sales closures or launch new projects during this period. They will probably conserve their marketing budgets for a more opportune time and postpone new project introductions,” he stated.

Mr. Surachet emphasized the need for condo developers to focus on rebuilding buyer confidence by prioritizing residents’ feelings of safety regarding their buildings.

A thorough inspection by qualified professionals and clear certification from relevant authorities or a designated government agency is crucial.

“This method is expected to restore trust more swiftly,” he explained. “It’s insufficient for developers to simply have their engineers inspect the buildings and declare them safe or rush to fix damages without ensuring that the repairs adhere to engineering standards.”

He suggested that condo buyers awaiting transfers during this period or within the year may reconsider their purchases, with more than 50% likely to seek cancellations.

The extent of these cancellations will largely depend on how much visible damage developers have and their ability to promptly restore confidence and manage the necessary repairs to their buildings.