Analysts suggest that the baht could potentially strengthen to test the 30-per-dollar level in the near future, driven by a sharp increase in international gold prices reaching new record highs and a broad weakness in the US dollar.

Gold prices surged to nearly US$4,500 an ounce on Tuesday, propelled by widespread US dollar weakness, escalating geopolitical tensions with US-Venezuela issues, and increased purchases from central banks.

As gold prices climb, the baht has appreciated to a 4.5-year high of approximately 31.10-31.12 against the dollar, amid the dollar index continuing its decline for a second consecutive session to 98.10 during early Asian trading hours.

The Thai baht has gained support from a sharp rally in the Japanese yen, which appreciated 0.7% to 156.00 against the dollar, prompting Japanese officials to issue stern warnings of intervention as the currency diverges from fundamental levels.

A currency trader noted, “In the short term, the baht could test the 31-per-dollar level or even move beyond that.”

Gold prices have surged nearly 70% this year, hitting multiple record highs, while the baht has increased by over 10%, making it the region’s top-performing currency.

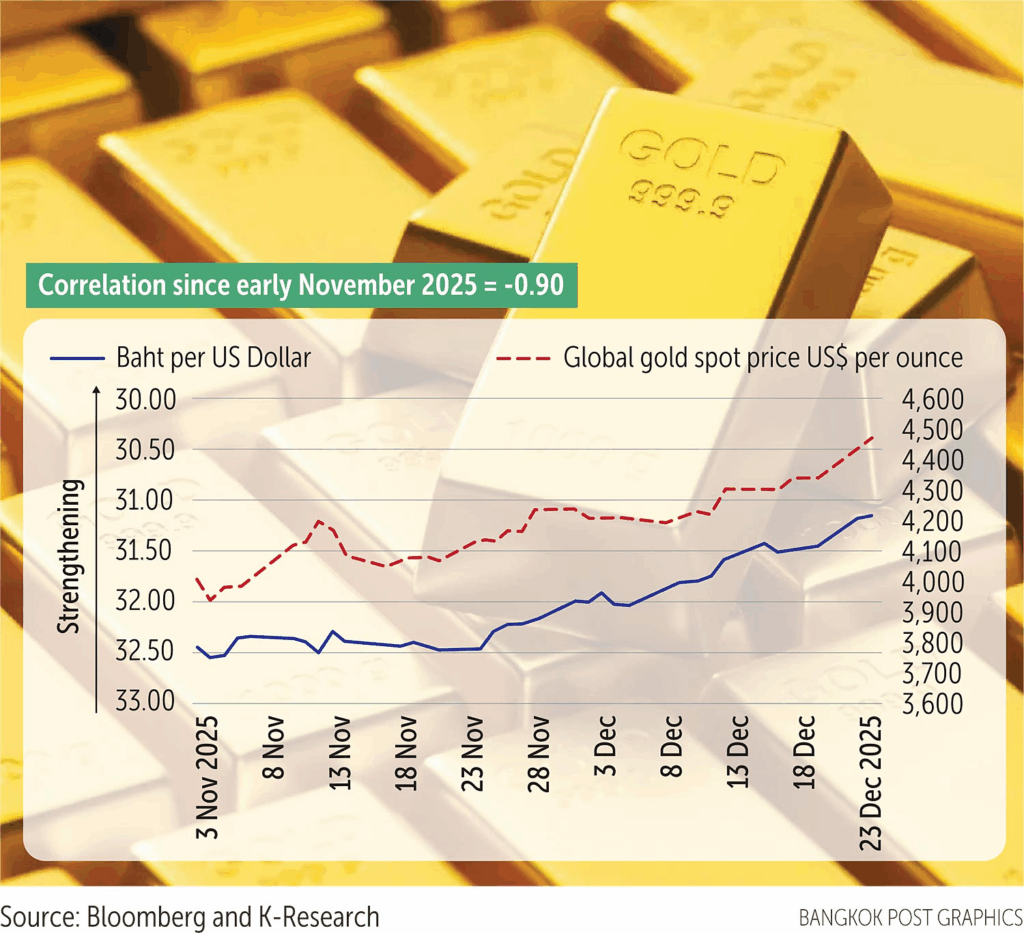

Ratasak Piriyanont, senior vice-president of investment strategy at Kasikorn Securities, commented, “There has been a relatively high correlation between the baht and gold prices this year, with both moving in the same direction and similar magnitude.”

Poonyawat Sreesing, senior economist at Siam Commercial Bank’s Economic Intelligence Center, said the baht has mainly been influenced by global factors, along with some domestic issues that remain unclear.

He added, “It appears the Bank of Thailand has not fully identified the domestic reasons behind the recent sharp appreciation of the baht. Although the regulator has tried various measures to control capital flows, especially ‘grey money,’ these efforts take time to impact the currency’s strength.”

Poonyawat emphasized that the central bank and other authorities should avoid implementing overly strict measures.

“Thailand’s capital market is still fragile, and excessive intervention could have adverse effects,” he warned.

Kanjana Chockpisansin, head of research in banking and finance at Kasikorn Research Center, highlighted the need for greater coordination among relevant agencies.

“Enhanced collaboration in data collection, monitoring gold transactions, and tracking the currency flows is crucial to addressing the issue effectively and achieving better outcomes,” she stated.