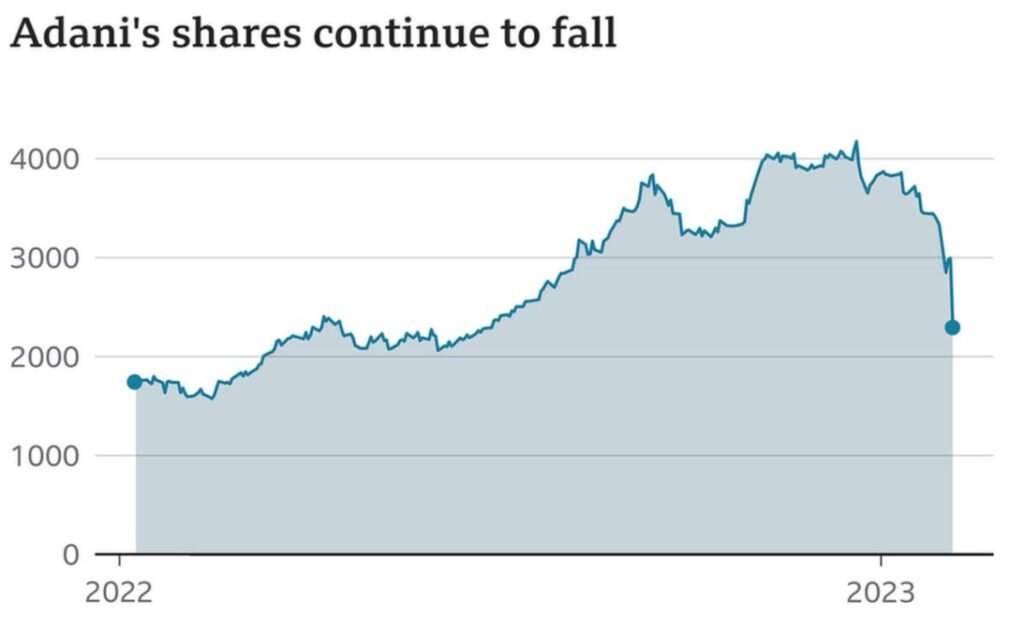

The value of Gautam Adani’s conglomerate has lost $100 billion due to the stock market collapse, which the Indian billionaire tried to stop by reassuring fearful investors about. On Thursday, shares of his companies continued to decline.

The 60-year-old businessman abruptly backed out of a $2.5 billion deal to sell new shares in his flagship company, Adani Enterprises, just 24 hours after it was sealed. “For me, the interest of my investors is paramount and everything is secondary,” he said in a recorded video address that was later posted.

We will review our capital market approach once the market has stabilized, he continued.

It was the first time the businessman had addressed the market chaos that had reduced his net worth by about $50 billion in less than a week, dethroning him as Asia’s richest man. To calm the markets, however, it was insufficient. Adani Enterprises stock slumped 25% on Thursday, while shares of his other businesses tumbled between 5% and 10%.

As soon as American short seller Hindenburg Research accused the conglomerate of deceit and stock market manipulation, the value of Adani Group shares began to see an unheard-of decline. Seven of the group’s companies are publicly traded, and since Hindenburg issued its analysis on Tuesday, the group’s value has decreased by 50%.

According to a person with firsthand knowledge of the situation, Reuters reported on Wednesday that the Securities and Exchange Board of India (SEBI) was investigating the stock price drops and any potential irregularities in the failed share sale in addition to looking into the stock price declines.

Requests for comment have not received a response from the SEBI to date.

Bloomberg reported on Thursday, citing anonymous sources, that India’s central bank has requested information from lenders over their debt exposure to the Adani Group. Requests for comment from the Reserve Bank of India were not entertained.

Foreign investors are getting a “rude awakening”

One of India’s most well-known businessmen is embroiled in a controversy that might have greater repercussions for the country’s rapidly expanding economy, which was only two weeks ago aggressively courting international investment at the World Economic Forum in Davos

According to Saurabh Mukherjea, founder of Marcellus Investment Managers, “it is apparent from looking at broader market activity that foreign investors…have had an unpleasant awakening.”

Experts cautioned that the aftermath of the Hindenburg report could affect other significant Indian enterprises.

According to Manish Chowdhury, head of research at brokerage Stoxbox, “The Adani saga has opened a giant bag of worms.” Foreign investors now “seem weak” about the India story, he continued.

Investors will now be “skeptical,” according to Chowdhury, regarding the accounting processes used by all Indian companies, while Mukherjea claimed that his clients have already begun to inquire more frequently.

Naturally, they are asking us to provide some guidance on Indian company governance and accounting practices. The prime minister of India is thought to be close to Adani.

A review into the Hindenburg report has also been requested by opposition legislators. On Wednesday, they even organized a protest within the Indian parliament during the presentation of the nation’s annual budget.

According to Stephen Innes, managing partner of SPI Asset Management, “This will definitely be a turn-off for significant international investors now that it has become a political issue.”

Overleveraged?

The Adani Group was accused by Hindenburg Research of “brazen stock manipulation and accounting fraud scheme over the course of decades” in an investigation that was published on January 24.

The research company questioned the “sky-high values” of the Adani companies and claimed that their “considerable debt” placed them all “on a perilous financial footing.” With 88 queries, it left off its report.

These range from requesting information on Adani’s offshore entities to requesting an explanation for its “such a complicated, interconnected corporate structure.”

Although the Adani Group had swiftly criticized the report as “baseless” and “malicious,” the founder of the firm addressed for the first time about the situation in the video address.

Analysts have long expressed concern that the rapid growth of Adani’s enterprises entails significant risk. One of the most indebted firms in India, the company has been propelled by a borrowing binge of $30 billion.

The Fitch Group-owned research company CreditSights produced a study on Adani Group last year titled “Deeply Overleveraged” in which it highlighted grave worries about the company’s intentions for debt-financed growth.

At the time, The Adani Group stated that its companies’ “leverage ratios” “remain to be healthy and are in line with the industry benchmarks in the respective industries.”

Adani claimed in his video message that the organization’s fundamentals were “solid” and that it had a “impeccable track record of honouring” its financial obligations.

He claimed the withdrawal of the Adani Enterprise share offering was done to save investors from losses because the shares had been trading significantly below the offer price since last week.

“This choice won’t have any effect on our current activities or our future goals. We will keep placing a priority on the prompt execution and delivery of projects, the speaker stressed.