The US is winning the China chip competition.

For more than a century, the race for oil created diplomatic disputes, pushed unorthodox alliances, and sparked wars.

These days, the two largest economies in the world are fighting over semiconductors, the chips that actually power our daily lives.

The $500 billion business that uses these microscopic silicon shards is predicted to grow nearly double by 2030. The key to becoming an unrivaled powerhouse lies with whoever controls the supply chains, which are a complex web of nations and businesses that manufacture semiconductors.

China wants the equipment to make semiconductors. Because of this, Beijing is being cut off by the US, a major supplier of technology.

According to Chris Miller, author of Chip Wars and associate professor at Tufts University, the two nations are unmistakably engaged in an arms competition in the Asia Pacific.

But there is more to the race, the author continues: “[It] takes place both in traditional areas, like numbers of ships, or missiles produced, but increasingly, it’s taking place in terms of the quality of Artificial Intelligence (AI) algorithms that may be used in military systems.”

Although the US is now winning, the chip war it has started with China is altering the global economy.

Chip manufacturers

The production of semiconductors is intricate, specialized, and tightly integrated.

Chips used in an iPhone are created in the US, produced in Taiwan, Japan, or South Korea, and then assembled in China. India, which is investing more in the sector, may have a greater impact in the future.

Although the US is where semiconductors were first developed, East Asia eventually became a manufacturing powerhouse thanks in large part to subsidies and other government incentives.

As a result, Washington was able to forge strategic alliances and business relationships in a region during the Cold War that was susceptible to Russian influence. Even more so now, given Beijing’s expanding influence in the Asia Pacific.

The competition is on to produce the most effective and effective chips at scale, and the smaller, the better. How many transistors—tiny electrical switches that can turn a current on or off—can you put into the tiniest piece of silicon wafer? That is the problem.

Jue Wang, a partner in Silicon Valley at Bain & Company, described Moore’s law, which is effectively doubling the transistor density over time, as being a difficult goal to attain.

It’s what makes our phones faster, our digital photo collections larger, our smart home appliances gradually smarter, and our social media material more varied.

Meeting outside the G20 Summit in Indonesia is US President Joe Biden and Chinese President Xi Jinping.

SOURCE OF IMAGE: GETTY IMAGES

image’s caption

Washington wants to prevent China from accessing the technology that creates semiconductors.

Even for the best chip manufacturers, getting there is difficult. Midway through 2022, Samsung became the first business to scale up the mass production of three-nanometer semiconductors. Later that year, the largest chip manufacturer in the world and a significant supplier to Apple, Taiwan Semiconductor Manufacturing Company (TSMC), followed.

How limited is that? Approximately 50–100,000 nanometers wide, a strand of human hair is far thinner.

These “leading edge” processors are more potent despite being smaller, thus they are used in more expensive gadgets like supercomputers, artificial intelligence, and the internet of things.

Additionally profitable is the “lagging edge” chip business, which powers appliances like refrigerators, microwaves, and washing machines that are more commonplace in our lives. But in the future, demand will probably decline.

The majority of the world’s chips are today produced in Taiwan, giving the self-governing island what its president refers to as a “silicon shield” and shielding it from China, which also claims the region.

Beijing is also spending heavily in supercomputers and AI and has made semiconductor fabrication a national priority. Despite not being a global leader, it has been coming up swiftly in the last ten years, particularly in terms of chip design capabilities, according to Mr. Miller.

He continued, “You see historically, anytime powerful countries have advanced computing technology, they deploy it to intelligence and military systems.

This, along with its supply reliance on Taiwan and other Asian nations, is rattling America.

How is the US obstructing China’s development?

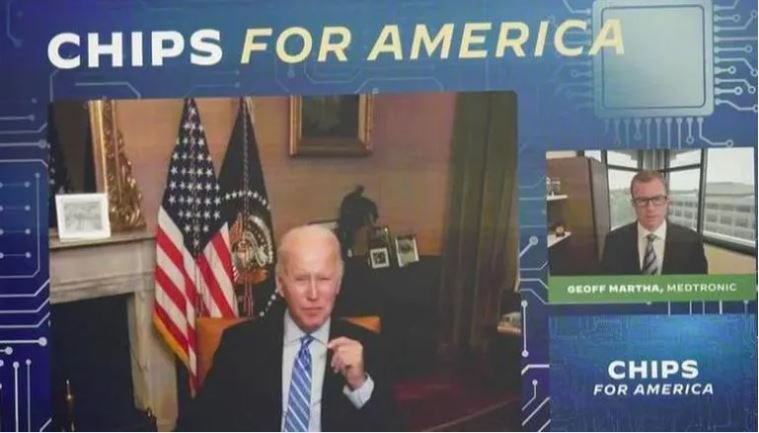

China’s access to chip-making technology is being restricted by the Biden administration.

Washington established extensive export curbs last October, making it nearly impossible for businesses to ship semiconductors, chip-making machinery, and software containing US tech to China, wherever they may be located in the world.

Additionally, it outlawed the “creation or production” of chips at specific Chinese factories by US citizens and lawful permanent residents.

How the US-China chip battle is progressing

US attempts to compete with China by investing heavily in technology

Because it imports both the equipment and the talent that power its developing chip manufacturing industry, this has a particularly negative impact on China.

About 25% of the money that ASML in the Netherlands used to get from China is expected to disappear. It is the sole business that produces the most cutting-edge lithographic machines, which are used to create “leading edge” chips.

“Talent is crucial in this industry; if you look at the CEOs of Chinese semiconductor firms, you’ll notice that many of them have American passports, have received their training there, and have green cards. This presents China with a really serious challenge “According to Linghao Bao, an analyst at the Chinese policy research firm Trivium.

Moreover, the US wants to produce more chips. The Chips and Science Act provides US semiconductor manufacturers with grants and subsidies totaling $53 billion. Major players are utilizing that to their advantage. As its only facilities outside of Taiwan, TSMC is investing $40 billion in two sites in the US.

Workers assemble semiconductor wafers at a plant owned by Jiangsu Azure Corporation Cuoda Group.

SOURCE OF IMAGE: GETTY IMAGES

China purchases more than 50% of the world’s manufacturing chips.

The largest memory chip producer in the US, Micron, has revealed plans to invest up to $100 billion over the next 20 years in a chip manufacturing facility in upstate New York. Memory chips are crucial for supercomputers, military technology, and any device with a processor.

According to Sanjay Mehrotra, CEO of Micron Technology, “The Chips Act is able to bridge the cost gap that exists in production in the US versus Asia.” “Micron will keep making investments in our Asian fabs (plants). The fact that there will be an even playing field everywhere is crucial.”

Play by China

China is feeling the effects of US limitations.

The restrictions reportedly caused Apple to abandon an agreement to purchase memory chips from Yangtze Memory Technologies Corp (YMTC), one of China’s most prosperous chip makers.

presenter-friendly gray line

Trade globally

More of the series by the BBC that examines trade from a global viewpoint.

presenter-friendly gray line

Mr. Bao predicts that this will go similarly to the Huawei experience. According to Mr. Bao, the communications giant went from being the second-largest smartphone manufacturer in the world, behind Samsung, to being “almost dead.”

“So, that is how simple it was for Washington to bring down a Chinese technology company. China’s options for replying to that aren’t really good. Previously, the US was focusing on specific Chinese businesses. But now the entire nation is included in the discussion.”

Amid security concerns, the US forbids the sale of Chinese technology.

Two Huawei 5G kit removal dates have been extended

Can China take any action in retaliation? A time when its economy is experiencing a severe slowdown, removing commodities or services or enacting its own export bans could cause more harm than help.

The World Trade Organization (WTO) has received a complaint from Beijing, but a resolution may take years.

Meanwhile, experts predict that China would increase investment in and support for its local chip manufacturing sector.

At the Huawei flagship store in Shenzhen, customers examine the cellphones that are on display.

Caption for photo:

President Xi Jinping declared at the 20th Congress of the Chinese Communist Party in October, “We will concentrate on national strategic necessities, gather strength to carry out indigenous and leading scientific and technology development, and resolutely win the war in vital core technologies.”

What follows then?

The industry must deal with issues like growing prices, a rocky reopening of China’s economy, and a short-term global recession caused by the conflict in Ukraine.

Given that the Covid epidemic severely damaged Beijing’s economy, caution will be advised.

“US businesses, Taiwanese businesses, Chinese businesses, and businesses from other nations will continue to communicate often. China is making an effort to develop its own US-free supply chain, while the US is making a deliberate effort to exclude China from innovation networks at the cutting edge of logic and memory chips “Miller stated.

That might entail a partial decoupling of the ecosystem, with one eye on China and the other on the rest of the globe, he continues.

The effects on the world economy are enormous. It will compel participants to declare their allegiance, perhaps preventing many from accessing the Chinese market.