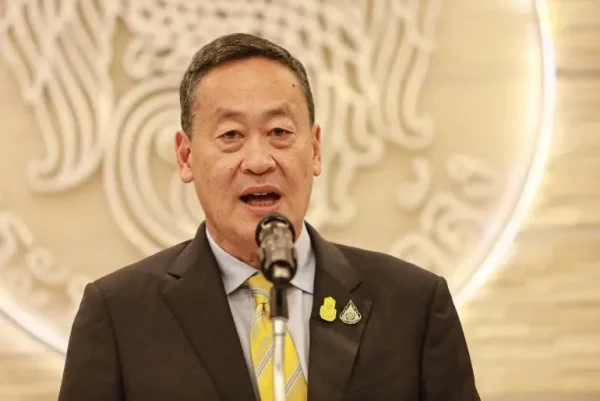

Thailand’s Prime Minister Srettha Thavisin has called on the central bank to consider reducing borrowing costs in order to support the country’s economy. This signal of disagreement between fiscal and monetary policymakers comes as consumer prices continue to decline, indicating room for monetary policy easing.

The Prime Minister believes that the central bank’s tightening measures, including interest rate increases, have negatively affected the economy, particularly small and medium enterprises and low-income groups. The Bank of Thailand had left its policy rate unchanged at 2.5% in November, but will review its policy again on February 7 as the government aims to stimulate growth and consumer spending.

Thailand’s economy has been slow to recover from the pandemic, and the Prime Minister is looking to accelerate the growth rate to 5%. However, the World Bank predicts that Thailand’s potential economic growth will be the lowest in the ASEAN region over the next 20 years.

It is worth noting that disagreements between the Prime Minister and the central bank have arisen in the past, especially regarding the government’s proposed cash handout program. The central bank has not yet indicated whether it is willing to consider easing monetary policy despite the recent decline in consumer prices attributed to state subsidies. The Thai baht reacted to the Prime Minister’s comments by falling in value.